Wealthsimple takes on Big Six with launch of credit cards and loans

-

This post did not contain any content.

Wealthsimple takes on Big Six with launch of credit cards and loans - The Logic

Toronto fintech broadens challenge to concentrated banking system beyond investing.

The Logic (thelogic.co)

Huh, interesting. 2% cash back on everything - https://www.wealthsimple.com/en-ca/credit-card Can join the waitlist via the app

I’ve been using wealthsimple for years now and really happy with them. Their free tax service is great, and makes it super easy when they already have your investment info.

We’re offering a credit card with a 2% unlimited cash back rate. This applies to all purchases you make, excluding:

- cash-like transactions,

- refunds,

- fees, and

- adjustments.

The credit card also offers the following benefits:

- No foreign transaction fees or other junk fees

- Flexible cash back deposited into your Wealthsimple chequing account monthly

- Pay with your Apple and Google mobile wallets

- Instantly pay down your balance with your Wealthsimple chequing account

- Access to all Visa Infinite benefits and offers

No fx fees is nice too

-

This post did not contain any content.

Wealthsimple takes on Big Six with launch of credit cards and loans - The Logic

Toronto fintech broadens challenge to concentrated banking system beyond investing.

The Logic (thelogic.co)

Looks like a no brainer. If you’re already a Wealthsimple client they ask you for consent to do a soft inquiry on your credit report. I like that a lot more than a hard hit. Especially for something I know without a doubt I’m qualified for. Time to get rid of a card I’ve been meaning to ditch for a while now (no rewards at all).

-

Looks like a no brainer. If you’re already a Wealthsimple client they ask you for consent to do a soft inquiry on your credit report. I like that a lot more than a hard hit. Especially for something I know without a doubt I’m qualified for. Time to get rid of a card I’ve been meaning to ditch for a while now (no rewards at all).

Happy cake day!

-

Hey, thx! Didn’t even notice that until you pointed it out. Two years since the fuck spez “mass exodus” from Reddit.

-

Hey, thx! Didn’t even notice that until you pointed it out. Two years since the fuck spez “mass exodus” from Reddit.

I love the red cake badge your name is showing on my client.

-

I love the red cake badge your name is showing on my client.

Here’s what I see using Acrtic for iOS (Blue cake) and Voyager for iOS (multicolour cake)

-

Here’s what I see using Acrtic for iOS (Blue cake) and Voyager for iOS (multicolour cake)

Looking pretty tasty on Arctic and Voyager. Here is Mlem’s:

-

Huh, interesting. 2% cash back on everything - https://www.wealthsimple.com/en-ca/credit-card Can join the waitlist via the app

I’ve been using wealthsimple for years now and really happy with them. Their free tax service is great, and makes it super easy when they already have your investment info.

We’re offering a credit card with a 2% unlimited cash back rate. This applies to all purchases you make, excluding:

- cash-like transactions,

- refunds,

- fees, and

- adjustments.

The credit card also offers the following benefits:

- No foreign transaction fees or other junk fees

- Flexible cash back deposited into your Wealthsimple chequing account monthly

- Pay with your Apple and Google mobile wallets

- Instantly pay down your balance with your Wealthsimple chequing account

- Access to all Visa Infinite benefits and offers

No fx fees is nice too

The product is good and the company is fine for the most part. Although customer service is noticeably worse in the last few years even for whatever they call the highest tier customers.

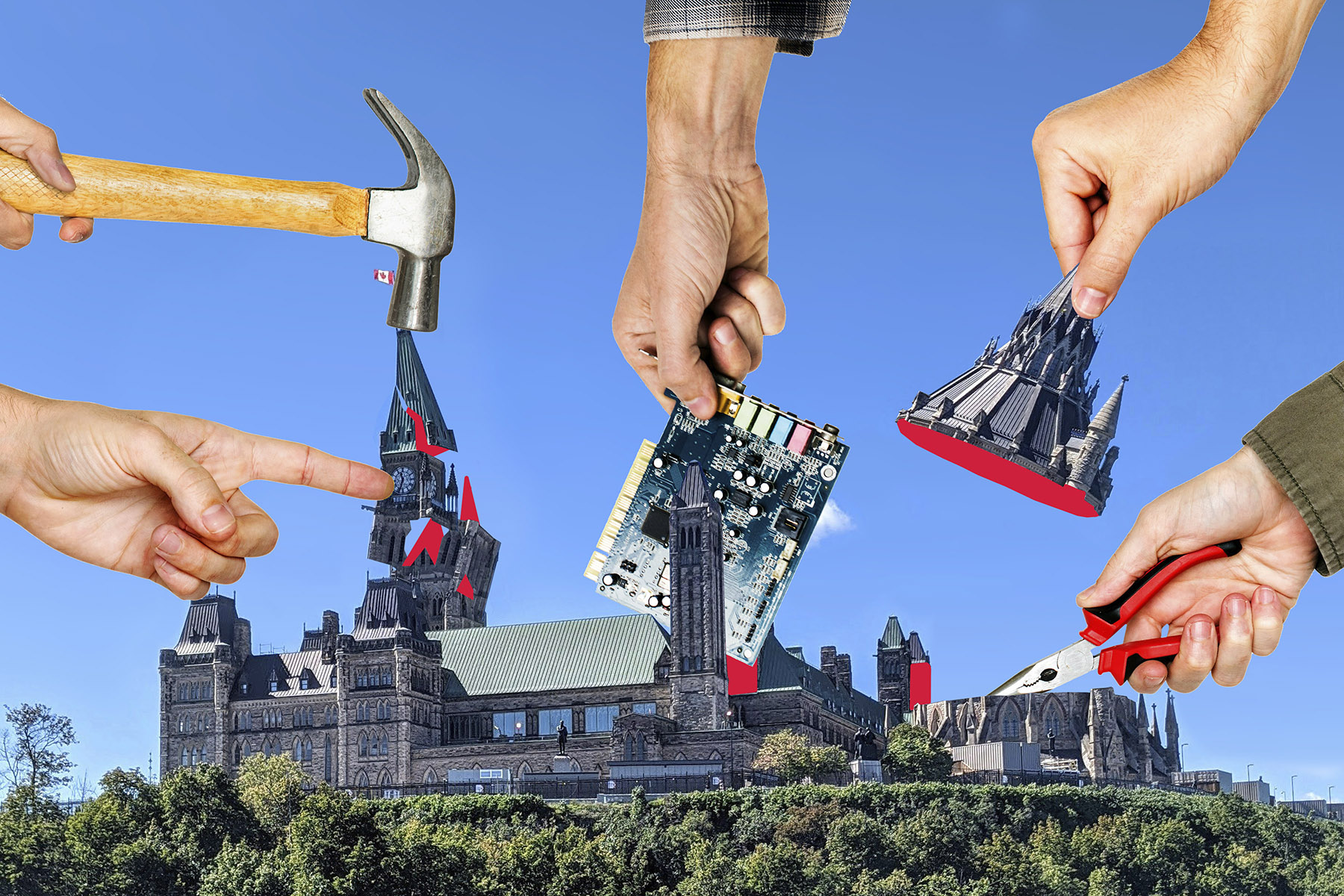

I found the whole Build Canada(bunch of c-suite guys lobbying for lower taxes, deregulation and reduction of government services) thing to be very off putting.

Are a Handful of Wealthy Tech Bros Bringing DOGE to Canada? | The Walrus

The country’s future is being treated like a software update

The Walrus (thewalrus.ca)

-

Looks like a no brainer. If you’re already a Wealthsimple client they ask you for consent to do a soft inquiry on your credit report. I like that a lot more than a hard hit. Especially for something I know without a doubt I’m qualified for. Time to get rid of a card I’ve been meaning to ditch for a while now (no rewards at all).

Only a no brainer if you can make the $10/mth fee back in cash-back ($500 in purchases?), or if you’re Premium or higher. Otherwise why not use the Mastercard Cash account card?

-

Looks like a no brainer. If you’re already a Wealthsimple client they ask you for consent to do a soft inquiry on your credit report. I like that a lot more than a hard hit. Especially for something I know without a doubt I’m qualified for. Time to get rid of a card I’ve been meaning to ditch for a while now (no rewards at all).

I’ve got the Costco Mastercard and it looks pretty comparable. Phone/ purchase protection, travel insurance, etc… Costco is 2-3% on some purchases and 1% on everything else, though you can only spend the cash back at Costco. Maybe if I took the time to pick between each I could average an extra 1/2%. More choice is always good though and this helps squeeze other issuers to get more competitive.

I think it’s easier to qualify for the Costco card though than the no fees for the WealthSimple one.

-

Only a no brainer if you can make the $10/mth fee back in cash-back ($500 in purchases?), or if you’re Premium or higher. Otherwise why not use the Mastercard Cash account card?

Who doesn’t spend $500 a month these days? Cellphone, gas & groceries would be that much or more. The fees are waived if you auto deposit your paycheque ($4k/moth or more).

From the FAQ….

How is the Wealthsimple credit card different from the Wealthsimple prepaid Mastercard? The credit card is a way of borrowing money, while the prepaid card is spending your own money that is already in your chequing account. When applying for the credit card, a credit check is required and using the card will affect your credit score — good payment history helps, while missed payments may affect your score negatively.

The cash back rewards are higher on the credit card, and it comes with some additional benefits like insurance and access to the Visa Infinite perks.

One other benefit that never gets mentioned and people don’t realize. Credit cards are safer for you as the consumer when it comes to fraud. If your card is compromised by a shady vendor it’s not your money that gets stolen. It’s the credit card company’s. It’s up to them to get it back. Using a debit card means it’s YOUR money that gets stolen and it’s up to you to fight to get it back. Meanwhile, your car payment or rent might bounce because your chequing account has been emptied.

-

I’ve got the Costco Mastercard and it looks pretty comparable. Phone/ purchase protection, travel insurance, etc… Costco is 2-3% on some purchases and 1% on everything else, though you can only spend the cash back at Costco. Maybe if I took the time to pick between each I could average an extra 1/2%. More choice is always good though and this helps squeeze other issuers to get more competitive.

I think it’s easier to qualify for the Costco card though than the no fees for the WealthSimple one.

You said it yourself. The Costco card has different reward percentages depending on what you buy and where. The benefit of this new card is the complete lack of categories. It’s just 2% across the board on all purchases at any store. When I shop at Costco I’d effectively be getting 4% cash back. 2% on this credit card and 2% because I have the executive membership.

-

You said it yourself. The Costco card has different reward percentages depending on what you buy and where. The benefit of this new card is the complete lack of categories. It’s just 2% across the board on all purchases at any store. When I shop at Costco I’d effectively be getting 4% cash back. 2% on this credit card and 2% because I have the executive membership.

Isn’t the WealthSimple card a Visa though? Costco only takes Mastercard so you wouldn’t be using it there. Costco card is 3% on Costco gas and restaurants, 2% on other gas and Costco.ca. For me that’s a big part of my spending.

Now if someone doesn’t do Costco then the WealthSimple card is probably a better option than lots of other cards. Particularly if they qualify for not paying the monthly fee.

-

Who doesn’t spend $500 a month these days? Cellphone, gas & groceries would be that much or more. The fees are waived if you auto deposit your paycheque ($4k/moth or more).

From the FAQ….

How is the Wealthsimple credit card different from the Wealthsimple prepaid Mastercard? The credit card is a way of borrowing money, while the prepaid card is spending your own money that is already in your chequing account. When applying for the credit card, a credit check is required and using the card will affect your credit score — good payment history helps, while missed payments may affect your score negatively.

The cash back rewards are higher on the credit card, and it comes with some additional benefits like insurance and access to the Visa Infinite perks.

One other benefit that never gets mentioned and people don’t realize. Credit cards are safer for you as the consumer when it comes to fraud. If your card is compromised by a shady vendor it’s not your money that gets stolen. It’s the credit card company’s. It’s up to them to get it back. Using a debit card means it’s YOUR money that gets stolen and it’s up to you to fight to get it back. Meanwhile, your car payment or rent might bounce because your chequing account has been emptied.

Who doesn’t spend $500 a month these days?

First off just to say this reply feels very privileged, there’s folks that can barely afford $100 in groceries a month… let alone 4K a month in deposits… is the card realistically for them? Maybe not. But still…

TY for the info on the card, I forgot that the Cash card is more like a debit card and doesn’t add to your Credit Score.

-

Isn’t the WealthSimple card a Visa though? Costco only takes Mastercard so you wouldn’t be using it there. Costco card is 3% on Costco gas and restaurants, 2% on other gas and Costco.ca. For me that’s a big part of my spending.

Now if someone doesn’t do Costco then the WealthSimple card is probably a better option than lots of other cards. Particularly if they qualify for not paying the monthly fee.

You’re absolutely right. I totally forgot about Costco only accepting Mastercard and debit.

-

Who doesn’t spend $500 a month these days?

First off just to say this reply feels very privileged, there’s folks that can barely afford $100 in groceries a month… let alone 4K a month in deposits… is the card realistically for them? Maybe not. But still…

TY for the info on the card, I forgot that the Cash card is more like a debit card and doesn’t add to your Credit Score.

You assume privilege. Let me correct you. I work two jobs and put in over 70hrs a week. I’ve been doing that for over 10yrs. That’s not privilege, that’s working my ass off to get ahead. I will admit that I’ve been very lucky in that my line of work was not negatively impacted by Covid. But that’s as far as I will concede.